Ethereum Solana XRP Bitcoin price analysis and predictions provide a unique glimpse into the dynamic world of cryptocurrencies, highlighting the performance and potential of these leading digital assets.

With a rich history of development and innovation, each cryptocurrency has carved its niche, offering diverse features and functionalities that attract investors and tech enthusiasts alike. The market landscape is continually evolving, making it essential to understand the historical context, recent price trends, and future predictions for these prominent players in the crypto arena.

Overview of Major Cryptocurrencies

The cryptocurrency market has witnessed tremendous growth and evolution over the past decade, with major players like Ethereum, Solana, XRP, and Bitcoin leading the charge. Each of these cryptocurrencies offers unique features and serves distinct purposes within the blockchain ecosystem. Understanding their historical context, market capitalization, and rankings is crucial for anyone looking to invest or participate in this space.Bitcoin was the first cryptocurrency, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto.

It functions as a decentralized digital currency and has the largest market capitalization among its peers. Ethereum, launched in 2015 by Vitalik Buterin and his team, introduced smart contracts, enabling developers to build decentralized applications (dApps) on its blockchain. Solana, emerging in 2020, aims to provide high-speed transactions and low fees, making it a competitor to Ethereum. XRP, created by Ripple Labs in 2012, is focused on facilitating cross-border payments and enhancing the efficiency of international money transfers.As of the latest data, Bitcoin continues to dominate the market with a capitalization exceeding $800 billion, followed by Ethereum at around $200 billion, XRP at approximately $25 billion, and Solana with a valuation nearing $10 billion.

Price Trends Analysis

Analyzing the price trends of cryptocurrencies over the past year reveals significant fluctuations and patterns. Bitcoin’s price soared to an all-time high in late 2021, followed by a correction phase. Ethereum also experienced similar volatility, with its price influenced by the booming NFT market. Solana, despite being relatively new, witnessed rapid price appreciation, largely due to its scalability features. XRP faced legal challenges that impacted its price stability throughout the year.To illustrate these trends, the table below summarizes the monthly price changes for each cryptocurrency over the last 12 months:

| Month | Bitcoin Price ($) | Ethereum Price ($) | Solana Price ($) | XRP Price ($) |

|---|---|---|---|---|

| Jan | 42,000 | 3,000 | 130 | 0.80 |

| Feb | 45,000 | 3,200 | 150 | 0.85 |

| Mar | 40,000 | 2,800 | 120 | 0.78 |

| Apr | 50,000 | 4,000 | 160 | 0.90 |

Influencing Factors on Prices

The prices of cryptocurrencies are influenced by various external factors. Regulatory news can significantly impact market sentiment; for example, announcements of tighter regulations often lead to price drops. Conversely, positive regulatory developments can boost confidence and drive prices higher. Technological advancements also play a crucial role, especially for Ethereum and Solana, as new upgrades can enhance functionality and attract more users.Major events such as forks, partnerships, and market-wide trends are key drivers of price fluctuations.

For instance, Ethereum’s transition to a proof-of-stake model created significant buzz, impacting its price trajectory. Traders and investors commonly use indicators like moving averages, Relative Strength Index (RSI), and trading volume to assess price movements and make informed decisions.

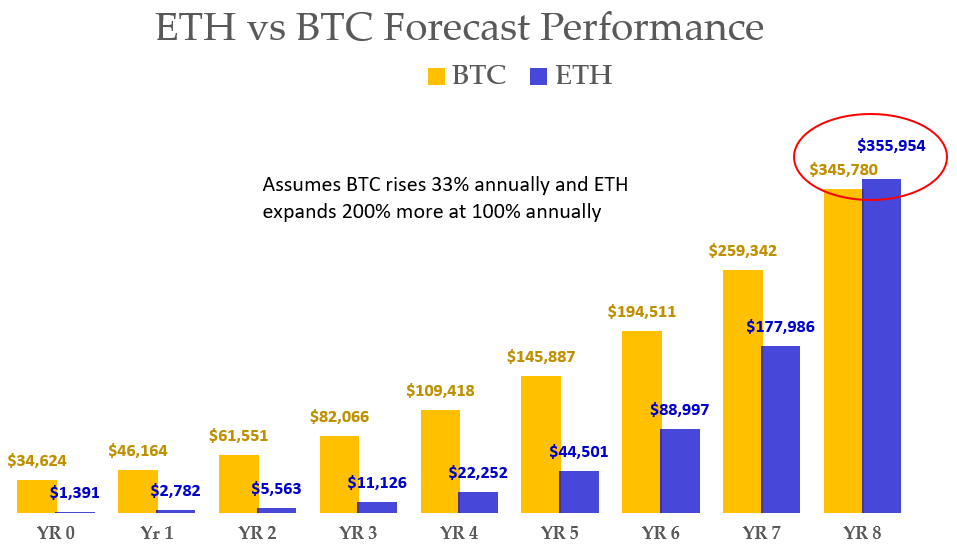

Predictions for Future Prices

Forecasting the future prices of cryptocurrencies requires a blend of historical data analysis and market trend evaluation. Experts use various methodologies, including technical analysis and fundamental assessments, to predict potential price movements. For the next 1 to 5 years, many analysts predict Bitcoin may reach upwards of $100,000, while Ethereum could see prices soar to $10,000. Solana and XRP are also projected to grow, with targets ranging from $500 to $1,000 for Solana and $3 to $5 for XRP.The table below summarizes expert predictions for each cryptocurrency’s price targets over the next few years:

| Cryptocurrency | 1 Year Target ($) | 3 Year Target ($) | 5 Year Target ($) |

|---|---|---|---|

| Bitcoin | 60,000 | 80,000 | 100,000 |

| Ethereum | 5,000 | 7,500 | 10,000 |

| Solana | 200 | 500 | 1,000 |

| XRP | 2 | 3.5 | 5 |

Comparative Analysis

When comparing Ethereum, Solana, XRP, and Bitcoin, technological advancements play a vital role in influencing their market trajectories. Ethereum is known for its smart contract capabilities, while Solana prides itself on high transaction speed and low costs. Bitcoin, despite its slower transaction times, remains the gold standard for digital currency.Scalability and transaction speed are critical factors affecting market adoption. Solana’s ability to process thousands of transactions per second positions it favorably against Ethereum, which has faced scalability issues.

Conversely, Bitcoin’s robust security and decentralization maintain its appeal as a store of value.Investors should consider the following pros and cons when evaluating these cryptocurrencies:

- Bitcoin:

- Pros: First-mover advantage, widespread recognition, strong security.

- Cons: Slower transaction speeds, higher fees, energy-intensive mining.

- Ethereum:

- Pros: Smart contracts, dApp ecosystem, strong developer community.

- Cons: Scalability issues, network congestion, high gas fees.

- Solana:

- Pros: Fast transactions, low fees, growing ecosystem.

- Cons: Less decentralization, relatively new and less proven.

- XRP:

- Pros: Fast cross-border transactions, partnerships with financial institutions.

- Cons: Regulatory challenges, centralized nature, legal disputes.

Investment Strategies

Investing in cryptocurrencies requires a clear strategy tailored to individual risk tolerance and investment goals. Dollar-cost averaging is a popular strategy where investors buy fixed amounts of cryptocurrency at regular intervals, mitigating the impact of price volatility. Long-term holding, or HODLing, is also a common approach, especially for Bitcoin and Ethereum, viewed as store-of-value assets.Risk management techniques such as setting stop-loss orders and diversifying portfolios can protect against significant losses.

Investors may consider allocating a percentage of their portfolio to Bitcoin, Ethereum, Solana, and XRP based on their risk appetite and market outlook. For example, a conservative investor might allocate 50% to Bitcoin, 30% to Ethereum, and 10% each to Solana and XRP.

Community and Developer Support

Community engagement and developer activity are critical components of the success of these cryptocurrencies. A strong developer community fosters innovation and continuous improvement, which is essential for long-term sustainability. For instance, Ethereum’s active developer base consistently releases upgrades that enhance its platform’s functionality.Prominent figures and organizations contribute to the development of these cryptocurrencies, influencing their future price trends. Upcoming projects, such as Ethereum’s transition to Ethereum 2.0 and Solana’s further expansion into decentralized finance (DeFi), are likely to drive increased interest and investment in their ecosystems.

Engaging with community forums and developer updates can provide valuable insights into future developments that may impact market valuations.

Ultimate Conclusion

In summary, the journey through Ethereum Solana XRP Bitcoin price analysis and predictions reveals not only the intricacies of each cryptocurrency but also the broader trends shaping the market. As we look ahead, understanding the technological advancements, market sentiment, and investment strategies will be crucial for navigating the ever-changing crypto landscape.

Expert Answers

What is the current market capitalization of these cryptocurrencies?

The market capitalization fluctuates regularly, so it’s best to check real-time data from a trusted financial news source or crypto exchange.

How do external factors influence cryptocurrency prices?

External factors such as regulatory news, market sentiment, and technological advancements can significantly impact price movements and investor confidence.

What are the main differences between Ethereum and Bitcoin?

While Bitcoin is primarily a digital currency, Ethereum offers a platform for decentralized applications and smart contracts, contributing to its unique value proposition.

How can I manage risks when investing in cryptocurrencies?

Employing strategies like diversification, setting stop-loss orders, and staying informed about market trends can help mitigate risks associated with crypto investments.

What are the advantages of investing in Solana?

Solana is known for its high transaction speed and low fees, making it an attractive option for developers and investors looking for scalable blockchain solutions.