Bitcoin vs ethereum future sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As two of the most prominent cryptocurrencies, Bitcoin and Ethereum have each paved their own paths in the digital economy. While Bitcoin is often viewed as a store of value, Ethereum is recognized for its versatility in powering decentralized applications. Understanding their differences, market dynamics, technological advancements, and future prospects reveals not just their individual natures, but also the broader implications for the crypto landscape.

Overview of Bitcoin and Ethereum

Bitcoin and Ethereum are two of the most prominent cryptocurrencies in the digital currency landscape, each serving different purposes and functionalities. Bitcoin, launched in 2009 by an anonymous entity known as Satoshi Nakamoto, was designed primarily as a decentralized digital currency and a store of value. In contrast, Ethereum, introduced in 2015 by Vitalik Buterin and others, functions as a platform for decentralized applications (dApps) and smart contracts, allowing developers to create complex functionalities on its blockchain.Historically, Bitcoin was the first cryptocurrency, leading to the establishment of the blockchain technology that underpins all cryptocurrencies today.

Ethereum quickly followed, expanding the capabilities of blockchain technology beyond mere transactions to include programmable contracts. Key milestones in their development include Bitcoin’s 2010 first recorded purchase of goods using cryptocurrency and Ethereum’s introduction of its own native token, Ether, which has facilitated countless projects and ICOs (Initial Coin Offerings) since its inception.The primary use cases for Bitcoin include online transactions, remittances, and as a digital gold or store of value.

Ethereum, on the other hand, is used widely for developing decentralized applications, facilitating Initial Coin Offerings, and executing smart contracts in various sectors, including finance, gaming, and supply chain management.

Market Performance Comparison

The market capitalization of Bitcoin and Ethereum has shown significant variations over the past five years, reflecting their respective growth and volatility. Bitcoin, often seen as the leading cryptocurrency, has maintained a higher market cap compared to Ethereum. However, Ethereum’s market cap has grown substantially, especially during periods of DeFi (Decentralized Finance) and NFT (Non-Fungible Token) booms.Over the last five years, price volatility for both cryptocurrencies has been considerable, with Bitcoin often witnessing sharp price swings due to market sentiment and regulatory news.

Ethereum also experiences volatility, particularly during major technological updates or network congestion. Notable events that impacted their prices include regulatory announcements, market crashes, and technological upgrades like Bitcoin’s halving events and Ethereum’s transitions to Ethereum 2.0.

Technological Advances

Both Bitcoin and Ethereum have introduced significant technological innovations. Bitcoin’s blockchain is primarily focused on secure and efficient peer-to-peer transactions, while Ethereum’s platform allows for the execution of smart contracts, enabling automated transactions without intermediaries. The consensus mechanisms of the two networks differ: Bitcoin employs a Proof of Work (PoW) system, which relies on miners solving complex mathematical problems, while Ethereum is transitioning to a Proof of Stake (PoS) model, which is expected to improve energy efficiency and scalability.

This transition aims to support a higher number of transactions per second compared to Bitcoin.To address scalability, Bitcoin is exploring solutions like the Lightning Network, which enables faster, off-chain transactions. Ethereum is actively working on upgrades related to sharding and Rollups to enhance its transaction throughput and decrease fees, thereby improving user experience on its network.

Adoption and Use Cases

Numerous industries are beginning to adopt Bitcoin and Ethereum for transactions, with Bitcoin being more prevalent in finance and investment sectors. Companies like Tesla and Square have recognized Bitcoin as a legitimate form of payment and store of value. In contrast, Ethereum is gaining traction in sectors like gaming, where developers build dApps that utilize its smart contract functionalities.Bitcoin serves as a store of value, often compared to gold, while Ethereum drives innovation in decentralized applications.

The following table illustrates the adoption rates across various demographics:

| Demographic | Bitcoin Adoption Rate (%) | Ethereum Adoption Rate (%) |

|---|---|---|

| Millennials | 40 | 25 |

| Gen Z | 30 | 35 |

| Institutional Investors | 60 | 45 |

| Developers | 15 | 55 |

Regulatory Landscape

The regulatory environment for Bitcoin and Ethereum varies widely across the globe, with both cryptocurrencies facing challenges. In the United States, for example, Bitcoin has been recognized as a commodity, while Ethereum’s status is less clear amid ongoing discussions about whether it is classified as a security.Recent regulatory developments have included proposals for stricter regulations to govern cryptocurrency exchanges and improve transparency.

These changes could significantly impact the future of both cryptocurrencies, as increased regulation may enhance legitimacy but could also stifle innovation and accessibility.

Future Predictions

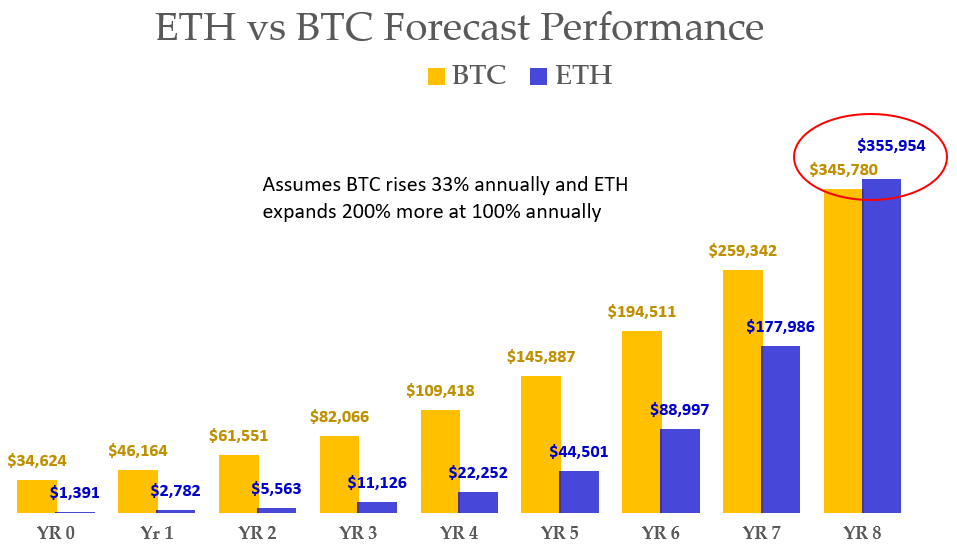

Experts are divided in their forecasts for Bitcoin and Ethereum’s future values. Some predict that Bitcoin could reach new all-time highs due to its scarcity and growing institutional adoption. Conversely, Ethereum’s value is projected to soar as the demand for decentralized applications and smart contracts grows.Potential future developments include Bitcoin’s continued market dominance operating as a store of value, while Ethereum is expected to further enhance its platform capabilities, potentially leading to broader adoption in various sectors.

The following table Artikels predictions for market trends over the next decade:

| Year | Bitcoin Price Prediction ($) | Ethereum Price Prediction ($) |

|---|---|---|

| 2025 | 100,000 | 10,000 |

| 2030 | 500,000 | 50,000 |

Investment Perspectives

When it comes to investment strategies, Bitcoin is often viewed as a long-term hold or a hedge against inflation, while Ethereum is favored for its growth potential driven by technology and innovation. Investors should consider the unique risks and rewards associated with each cryptocurrency.Bitcoin’s primary risk involves regulatory uncertainties and market volatility, while Ethereum faces competition from other smart contract platforms and the challenges of scaling its network.

Portfolio diversification including both cryptocurrencies may mitigate risks while maximizing potential returns, as they serve different roles in the digital asset ecosystem.

Community and Ecosystem

The communities supporting Bitcoin and Ethereum play a crucial role in their development and adoption. Bitcoin’s community is focused on maintaining its status as a decentralized currency, while Ethereum’s community is vibrant with developers and enthusiasts working on innovative projects and solutions.Community sentiment significantly impacts both cryptocurrencies, influencing market trends and user engagement. Key organizations associated with Bitcoin include the Bitcoin Foundation, while Ethereum has the Ethereum Foundation driving its development.

Both cryptocurrencies benefit from a collaborative ecosystem that fosters innovation and user adoption.

End of Discussion

In conclusion, the future of Bitcoin and Ethereum is not merely a reflection of their past but a window into the evolving world of cryptocurrency. With ongoing innovations, regulatory developments, and shifting market sentiments, both can occupy significant roles in the digital economy. Whether one aligns more with Bitcoin’s stability or Ethereum’s adaptability, the journey ahead promises to be both exciting and transformative.

Q&A

What are the main differences between Bitcoin and Ethereum?

Bitcoin primarily serves as digital gold or a store of value, while Ethereum focuses on enabling smart contracts and decentralized applications.

How do Bitcoin and Ethereum’s market performances compare?

Historically, Bitcoin has held a higher market capitalization, though Ethereum has shown significant growth and volatility, especially with its expanding use cases.

What future technological advancements can we expect for both?

Both networks are exploring scalability solutions; Bitcoin is working on the Lightning Network, while Ethereum is evolving with plans for Ethereum 2.0 and sharding to enhance performance.

How is regulatory pressure affecting Bitcoin and Ethereum?

Regulation can shape adoption and investment; both currencies face scrutiny, but favorable regulations could boost their legitimacy and use.

What investment strategies are recommended for Bitcoin and Ethereum?

Diversification is key; investors often allocate their portfolios to include both assets to balance potential risks and rewards.