ethereum bridge serves as a crucial link in the blockchain ecosystem, enabling interoperability between different networks and enhancing the overall functionality of decentralized applications. These bridges allow users to transfer assets across various blockchains, creating a more connected and efficient digital landscape.

With the increasing popularity of decentralized finance (DeFi) and multi-chain platforms, understanding Ethereum bridges’ advantages, challenges, and mechanisms is essential for anyone looking to navigate this space effectively.

Introduction to Ethereum Bridges

Ethereum bridges are essential components of the blockchain ecosystem, enabling interoperability between different blockchain networks. These bridges allow users to transfer assets and data across various platforms seamlessly, thereby enhancing the overall functionality and reach of decentralized applications (dApps). The primary purpose of Ethereum bridges is to facilitate cross-chain interactions, enabling users to leverage the unique features of multiple blockchains without being restricted to a single network.Using Ethereum bridges comes with its own set of advantages and disadvantages.

On one hand, they offer increased liquidity, greater access to diverse DeFi applications, and the ability to utilize different blockchain technologies. On the other hand, they can also introduce security risks, higher transaction fees, and potential delays in asset transfers. In this context, Ethereum bridges play a crucial role in creating a more interconnected blockchain environment.

Types of Ethereum Bridges

Ethereum bridges can be categorized into two main types: centralized and decentralized bridges. Centralized bridges are operated by a single entity, which manages the asset transfers and ensures the security of the transactions. These are typically faster and easier to use but may pose risks regarding trust and reliance on a single point of failure. On the contrary, decentralized bridges utilize smart contracts and consensus protocols to facilitate transfers, providing greater security and autonomy for users but often at the cost of slower transaction times.Several Ethereum bridges are available in the market, each with its own unique functionalities.

The most notable ones include the following:

- Wrapped Bitcoin (WBTC): This bridge allows Bitcoin to be used on the Ethereum network as ERC-20 tokens.

- Polygon Bridge: It connects Ethereum to the Polygon network, enabling faster and cheaper transactions.

- Binance Smart Chain (BSC) Bridge: This bridge allows for asset transfers between Ethereum and BSC, tapping into DeFi opportunities on both platforms.

The technology behind wrapped tokens is fundamental to Ethereum bridges. Wrapped tokens represent an asset from one blockchain on another blockchain, maintaining a 1:1 peg to the original asset. This allows for seamless cross-chain interactions while retaining the value and utility of the original asset.

Working Mechanisms of Ethereum Bridges

The technical processes involved in transferring assets across Ethereum bridges are complex but essential for ensuring secure transactions. When a user initiates a transfer, the Ethereum bridge locks the original asset in a smart contract on the source blockchain, creating a corresponding wrapped token on the destination blockchain. This transaction typically involves several key steps:

- User requests a transfer on the sending blockchain.

- The bridge locks the asset in a smart contract.

- A wrapped token is minted on the receiving blockchain.

- The user can now use the wrapped token within the destination network.

A flowchart illustrating this transaction process highlights the step-by-step journey of an asset through an Ethereum bridge, showcasing how it transitions from one blockchain to another.Security measures are paramount in Ethereum bridges to prevent fraud and asset loss. These measures include multi-signature wallets, time locks, and continuous monitoring of smart contracts for vulnerabilities. Additionally, many bridges undergo audits by reputable third-party organizations to ensure their security protocols are robust and reliable.

Popular Ethereum Bridges

Several Ethereum bridges have gained popularity due to their unique features and functionalities. Here’s a list of some of the leading Ethereum bridges along with their standout features:

- Hop Protocol: Enables fast transfers between Layer 2 networks and Ethereum with minimal fees.

- Celer cBridge: Provides a multi-chain bridge with advanced liquidity options.

- Portal Bridge: Focuses on bridging assets between multiple blockchains while maintaining user privacy.

Statistics regarding the usage and transaction volume of these bridges reveal their significant impact on the Ethereum ecosystem. For instance, the Hop Protocol has seen an exponential increase in transaction volume, indicating a growing interest in cross-chain solutions. Community feedback highlights user experiences, with many users praising the efficiency and ease of use of decentralized bridges while also expressing concerns over transaction delays in certain scenarios.

Use Cases of Ethereum Bridges

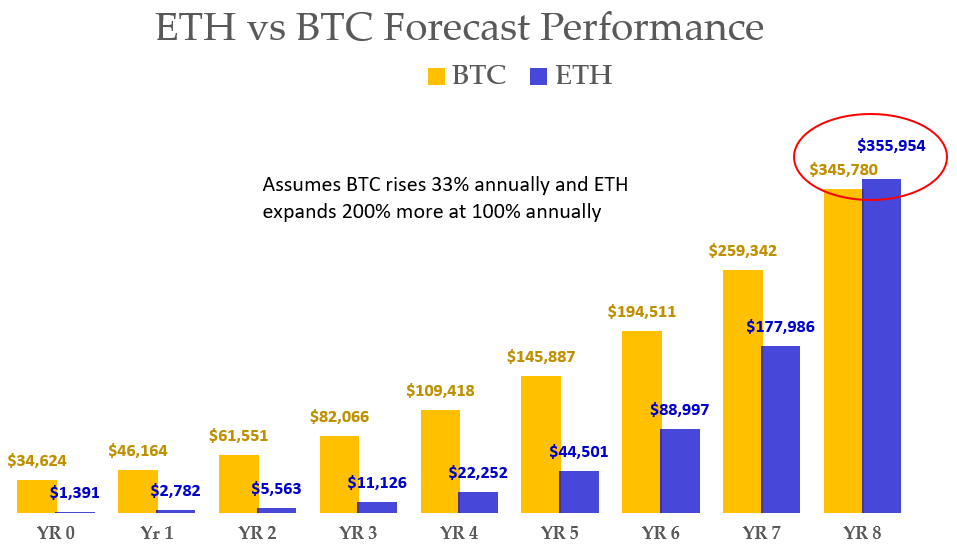

Ethereum bridges offer various use cases that enhance the utility of blockchain technology. They enable users to access decentralized finance (DeFi) applications across different networks, allowing for greater flexibility and potential returns on investment. For instance, a user can move their liquidity from Ethereum to Binance Smart Chain to take advantage of lower transaction fees and higher yield farming opportunities.In addition to DeFi, Ethereum bridges are beneficial for gaming, NFTs, and other applications requiring asset transfers.

For example, in a case study showcasing the integration of an Ethereum bridge, a gaming platform allowed players to transfer in-game assets between Ethereum and another blockchain, creating a more expansive and engaging gaming experience.

Future of Ethereum Bridges

The evolution of Ethereum bridges is poised to accelerate in the coming years, driven by advancements in technology and increasing demand for interoperability. Emerging trends such as Layer 2 scaling solutions and cross-chain decentralized autonomous organizations (DAOs) could further influence the development of Ethereum bridges, enabling even more seamless interactions between disparate networks.However, challenges remain, including the need for improved security measures and regulations that could impact the operation of these bridges.

As the blockchain ecosystem matures, addressing these challenges will be crucial for the continued success and adoption of Ethereum bridges.

Ending Remarks

In summary, Ethereum bridges are pivotal in shaping the future of blockchain technology by facilitating cross-chain interactions and expanding the possibilities for users and developers alike. As the ecosystem evolves, these bridges will continue to play a significant role in enhancing connectivity, opening new avenues for innovation, and overcoming existing limitations.

FAQ Guide

What is an Ethereum bridge?

An Ethereum bridge is a protocol that allows assets to be transferred between Ethereum and other blockchain networks, enabling cross-chain interactions.

Are Ethereum bridges safe to use?

While many Ethereum bridges implement robust security measures, the safety depends on the specific bridge and its technology; users should always do their research.

What are wrapped tokens in Ethereum bridges?

Wrapped tokens are assets that represent a cryptocurrency from another blockchain on the Ethereum network, allowing for their use within Ethereum-based applications.

How do I use an Ethereum bridge?

To use an Ethereum bridge, you typically need a compatible wallet and follow the bridge’s specific instructions for transferring assets.

What are the common challenges faced by Ethereum bridges?

Common challenges include security vulnerabilities, network congestion, and differences in transaction speeds between blockchains.